Reports

Publicerat: 2025-05-22 09:00:00

OPENING REMARKS

Hamlet BioPharma’s drug candidate Alpha1H has shown effective tumor-killing capabilities against bladder cancer cells and demonstrated strong efficacy in an extended clinical trial. The clinical part of the Phase I/II trial was completed at the end of December 2024 and data analysis was completed during Q3 and the beginning of Q4. All primary endpoints of safety and efficacy of Alpha1H treatment were reached. No drug- related serious adverse events were observed. Intravesical instillations of Alpha1H reduced the number and size of tumors and triggered massive shedding of tumor cells (primary endpoints). Shed cells and treated tumors contained Alpha1H, and both showed evidence of apoptosis. The expression of cancer-related genes was strongly inhibited in treated tumors compared to placebo (secondary endpoints). Based on the success- ful results from the randomized, placebo-controlled trial, along with additional dose-finding and technical analyses, Alpha1H - granted Fast Track status by the FDA - is now advancing toward Phase III studies in ongoing dialogue with the agency.

In the field of immunotherapy, we have reported positive results with the IL-1 receptor antagonist anakinra.

In a randomized Phase II study in patients with recurrent acute cystitis, anakinra has demonstrated therapeutic efficacy comparable to antibiotics, offering a potential alternative for cystitis patients including those who

are infected with antibiotic-resistant bacteria. Additionally, our Phase II study of patients with bladder pain syndrome, patients who have been treated with anakinra, show a reduction in pain score and an improved quality of life.

Hamlet BioPharma continues to drive the clinical programs forward with the goal of bringing these innovative therapies to market. Strategic alliances and commercial collaborations for our core assets in cancer and infections remain to be a key focus area for the company. The recent positive Phase II data puts renewed emphasis on the cancer and immunotherapy projects as well as the portfolio of preclinical projects.

Looking ahead, we remain committed to advancing our clinical programs and expanding our pipeline of innovative therapies to improve patient outcomes. Our goal is to complete Phase III trials and obtain market approval, partner late-stage assets, and enable global commercialization of Phase III-ready programs.

We are grateful for the continuing support of our shareholders and the dedication of our multinational team, as well as our external partners and collaborators.

We especially want to thank Helena Lomberg and Ulla Trägårdh, who have made great contributions to Hamlet BioPharma and are leaving the board. Helena Lomberg has made great contributions to the clinical trials strategy of the company and Ulla Trägård has strengthened the legal competence of the company.

Chairman of the Board CEO

SIGNIFICANT EVENTS

SIGNIFICANT EVENTS DURING THE THIRD QUARTER

On January 10, 2025, Hamlet BioPharma announced the continuation of the digital event series in the spring of 2025. These events provide participants a valuable opportunity to follow and discuss the drug development process and engage directly with the team during the Q&A sessions that follows each presentation (see video at: https://hamletbiopharma.com/series-of-digital-events/).

The meeting focused on Genetic sequencing technologies and biomarkers, with a presentation by Ass Professor Farhan Haq.

On February 3, 2025, Hamlet BioPharma announced its participation in the Swedish Research Council’s conference on antibiotic resistance on February 6, 2025, where the company presented on the topic ‘Attacking the Disease Instead of the Bacteria – Immunomodulation as an Alternative to Antibiotics.’ Addition- ally, on January 29, 2025, the company took part in Aktiespararna’s digital Life Science-themed evening, where the latest developments were presented (see video at: https://hamletbiopharma.com/news/media- archive/).

On February 12, 2025, Hamlet BioPharma invited to digital investor meeting on the 13th of February 2025.

On February 13, 2025, Hamlet BioPharma published the Q2 Interim report October – December 2024. The presentation at the digital Q2 meeting focused on the progress of non-antibiotic treatment strategies developed by the company and on the positive outcomes of the Phase II study in patients with recurrent acute cystitis.

On February 18, 2025, the Board of Hamlet BioPharma decided to appoint Catharina Svanborg as CEO. Catharina immediately assumes the CEO role and continues as a Board member. Martin Erixon left the CEO role and will be at the company’s disposal during his notice period. Board member Magnus Nylén was appointed by the board as temporary chairman of the board. The board decided to call an extraordinary general meeting to propose Professor Gabriela Godaly to be elected as a new board member and Chairman of the board.

On February 19, 2025, Hamlet BioPharma appointed Elisabeth Parker, PhD to strengthen the business development expertise in the company. Dr. Parker has 25 years’ experience of R&D, partnering and commer- cialization of therapeutics, diagnostics and enabling technologies. Dr. Parker leaves her current position as Senior Investment Advisor Healthcare and Life Sciences at Business Sweden to take up the 80% position with Hamlet BioPharma. Elisabeth Parker will leave the board of Hamlet BioPharma at the upcoming extra- ordinary general meeting as she now takes on a management role in the company.

On February 20, 2025, the board of Hamlet BioPharma proposed a licensing agreement with Linnane Pharma, which creates conditions for an effective commercialization of Bamlet and positive value for both companies. The Licensing agreement enables Linnane Pharma to commercialize products based on Bamlet, with the help of the supplementary patents, which are licensed from Hamlet BioPharma. In brief, through the licensing agreement Hamlet BioPharma will receive a royalty payment from Linnane Pharma of 25 percent of future revenues from the sale of products and other revenues such as license fees based on Bamlet. Linnane Phar- ma’s obligation to pay royalty compensation to Hamlet BioPharma applies according to the Licensing Agree- ment until and including the time when Linnane Pharma’s patent regarding Bamlet expires, which is in 2044.

On February 20, 2025, Hamlet BioPharma called for an Extraordinary General Meeting in Hamlet BioPharma AB to be held on March 11th, 2025.

On February 21, 2025, Hamlet BioPharma invited to digital investor meetings taking place on the 21st of February 2025 for discussions of the licensing agreement.

On March 11, 2025, a Communiqué from the Extraordinary General Meeting of Hamlet BioPharma AB was announced, including the approval of the licensing agreement on Bamlet between Hamlet BioPharma and Linnane Pharma and the election of Gabriela Godaly to the board and to the position as Chairman of the Board.

On March 12, 2025, Hamlet BioPharma invited to investor meeting on March 12th, 2025. Discussion about the licensing agreement and novel discoveries of Bamlet’s beneficial effects on metabolic health in animal models

SIGNIFICANT EVENTS AFTER THE THIRD QUARTER

On April 7, 2025, Hamlet BioPharma, announced that Hamlet BioPharma’s drug candidate Alpha1H has shown potent treatment effects in patients with cancer of the urinary bladder. The final analysis of the placebo- controlled, dose-escalation and repeated treatment study parts, confirmed the strong treatment effects compared to placebo. The Clinical study report is being completed for submission to the FDA.

On April 7, 2025, Hamlet BioPharma announced new granted patents added to Hamlet BioPharma’s extensive patent portfolio in cancer and infection. Hamlet BioPharma’s extensive patent portfolio comprises 147 granted patents and 33 pending cases. Strategy regarding intellectual property rights, follow up and extension of filed cases and patenting of new discoveries is overseen by the internationally established legal firm Greaves-Brewster LLP, who have advised Hamlet BioPharma since the start.

On April 8, 2025, Hamlet BioPharma announced the publication of new scientific advances important for the mechanism of action of Alpha1H in the treatment of bladder cancer, in collaboration with scientists at Lund University. A summary of the study, investigating the mechanism of action of Alpha1H, using high resolution imaging technology, was published on March 25th, 2025 in Life Science Alliance by the team at Lund Univer- sity, associated with Hamlet BioPharma. Link to the article: https://www.life-science-alliance.org/content/8/6/ e202403114.

On April 22, 2025, Hamlet BioPharma invited to digital investor meeting on the 23rd of April 2025 (see video at: https://hamletbiopharma.com/news/media-archive/). The progress of the Phase II projects presented in the company’s new executive summary (‘’teaser’’) were discussed.

On May 2, 2025, Hamlet BioPharma AB announced that the company’s drug candidate Alpha1H has been presented at the American Association for Cancer Research (AACR) Annual Meeting 2025 in Chicago, USA. AACR is one of the world’s most prestigious scientific conferences in the field of cancer and the company’s allocation of space at the meeting underlines the significance of Hamlet BioPharma’s progress. Link to the abstract: https://www.abstractsonline.com/pp8/#!/20273/presentation/10519.

COMPANY OVERVIEW

HAMLET BIOPHARMA: TAKING BREAKTHROUGH SCIENCE FROM DISCOVERY TO CLINIC IN AREAS OF HIGH UNMET NEED

Hamlet BioPharma is a drug company focused on the development of innovative treatments for cancer and infectious diseases. With a mission to address large, unmet medical needs, the company has built a robust pipeline of therapeutic candidates targeting malignant tumors and antibiotic-resistant infections. These achievements underscore Hamlet BioPharma’s potential as a leader in innovative drug development, advancing impactful therapies that respond to critical healthcare demands globally.

Key Developments

FDA IND Approval and Fast Track Designation: In July 2023, Hamlet BioPharma achieved a critical regulatory milestone with FDA approval of the Investigational New Drug (IND) application for Alpha1H, a synthetic peptide designed for the treatment of non-muscle invasive bladder cancer (NMIBC). By No- vember, Alpha1H received Fast Track designation, enabling accelerated FDA support throughout clinical development. This designation validates Alpha1H’s promise in addressing NMIBC—a cancer subtype with high recurrence rates and limited treatment options.

Phase II Clinical Success: The Phase II clinical trial for Alpha1H, conducted in collaboration with a special- ized clinic in Prague, has been completed. The analysis of clinical and laboratory revealed impressive anti- tumor activity. Results demonstrated dose-dependent efficacy, with 88% of patients treated with the higher dose experiencing partial or complete tumor responses. Furthermore, Alpha1H induced a positive immune response in patients, underscoring its dual potential as a tumor-targeting agent and an immunotherapeutic. This immune activation, a unique attribute of Alpha1H, holds promise for improving patient outcomes by engaging the body’s natural defences against cancer.

Manufacturing and Scaling: To support upcoming Phase III trials and future commercialization, Hamlet BioPharma has strengthened its manufacturing infrastructure through partnerships with industry-leading facilities, to ensure scalable production capabilities that align with Good Manufacturing Practices (GMP), essential for advancing Alpha1H toward widespread clinical use and, ultimately, market introduction. This groundwork reinforces Hamlet BioPharma’s readiness to meet clinical and commercial demands, placing Alpha1H on track for global distribution.

Completed Phase II Clinical Study of Recurrent Cystitis: Antibiotic resistance presents a growing global challenge, particularly in managing recurrent bacterial infections like cystitis. Hamlet BioPharma’s immuno- therapy, using the IL-1 receptor antagonist anakinra (IL-1RA), has emerged as a potential alternative to traditional antibiotic treatment. In Phase II trials conducted in Germany, IL-1RA was shown to be as effective as antibiotics in reducing symptoms and improving quality of life for patients with recurrent urinary tract infec- tions. Importantly, IL-1RA treatment may reduce the risc for bacterial antibiotic resistance development, in this large patient goup.

Market Differentiation: By focusing on an immunomodulatory approach, Hamlet BioPharma is offering an innovative solution to address the problem of antibiotic resistance. This treatment modality represents a paradigm shift in managing bacterial infections. By targeting the disease response, patient health can be improved and bacteria removed by normal defence mechanisms, rather than directly targeting the bacteria. In this way, infections caused by antibiotic resistant and antibiotic sensitive organisms can be targeted in animal models. This approach is also reduces the selective pressure that contributes to resistance in the environment and general population.

3. Strategic Alliances and Commercial Partnerships

Hamlet BioPharma has engaged in strategic collaborations with leading international advisory firms, to identify partners for the commercialization of company assets. These partnership strategies have placed Hamlet BioPharma on the map of the pharmaceutical industry, nationally and internationally. Discussions focus on the lead compound Alpha1H, recent positive Phase II data as well as the immunotherapy projects and the portfolio of preclinical projects, to identify new partnerships and strengthen existing networks.

The global demand for effective cancer therapies and alternative treatments for infections is expanding, and Hamlet BioPharma’s drug candidates are well-positioned to capture substantial shares within these high- growth markets. With innovative solutions that align with current healthcare priorities, Hamlet BioPharma

is addressing essential needs while positioning itself for sustainable growth.

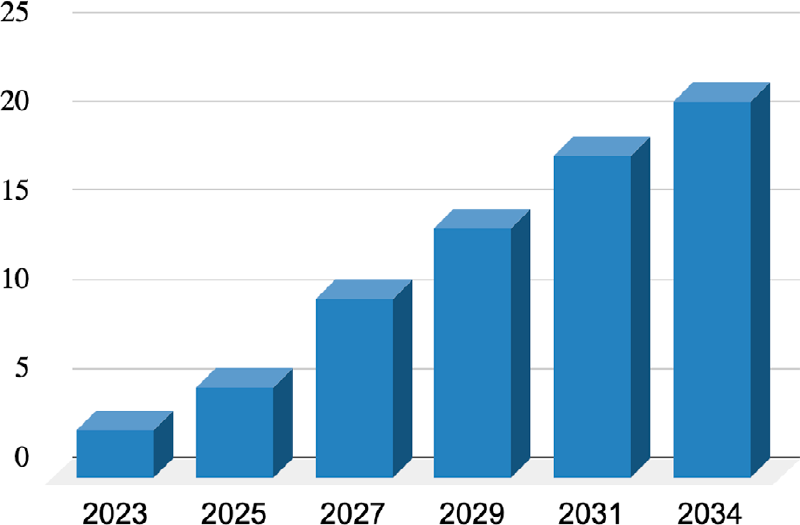

Market Growth and Demand for Alternatives: Bladder cancer has one of the highest recurrence rates, with non-muscle invasive bladder cancer (NMIBC) being particularly challenging. This cancer type often requires repeated treatments, which are costly and have limited effectiveness. According to Transparency Market Research, the NMIBC market is projected to grow from USD 2.6 billion in 2023 to an estimated USD 21.1 billion by 2034, at a compound annual growth rate (CAGR) of 21.4%. This growth is driven by an increasing focus on immunotherapies and the need for more effective, less invasive treatments.

Alpha1H’s Market Position: Alpha1H, with its promising clinical outcomes and immune activation profile, is uniquely suited to the need for new NMIBC treatment. As a Fast Track-designated therapy with documented anti-tumor effects, Alpha1H stands to become a valuable asset, in the global oncology market. Its innovative mechanism of action—targeting cancer cells while preserving healthy tissue—could make it a preferred alternative to traditional treatments, which are often associated with higher toxicity and frequent recurrences.

Market size Superficial Bladder Cancer 2023-2034

Market size Superficial Bladder Cancer 2023-2034

Source:

Transparency Market Research; https://www.transparencymarketresearch.com/ non-muscle-invasive-bladder-cancer-market.html

Year

2. Infection Control and Alternatives to Antibiotics

Demand for Non-Antibiotic Solutions: The World Health Organization (WHO) has highlighted antibiotic resistance as one of the most urgent threats to public health. In the United States alone, the recurrent cystitis treatment market is valued at approximately USD 2 billion annually, with steady growth anticipated over the next decade. Driving this growth is the increasing demand for non-antibiotic therapies to manage infections, as antibiotic resistance continues to complicate treatment protocols. Analysts project a CAGR of 6-8% in this sector, with growing interest for immunomodulatory therapies like IL-1RA.

IL-1RA’s Potential: By harnessing the body’s immune response to combat infections, IL-1RA represents a safer, resistance-free alternative to antibiotics. It not only reduces infection symptoms but also preserves the beneficial microbiome, helping to counteract the rise of multi-drug-resistant infections. This makes IL-1RA an attractive option for patients, healthcare providers, and regulatory bodies alike.

Market size Recurrent Acute Cystics 2023-2034

Year

Source:

Data are estimated values to represent market development from reports and research from the American Urological Association (AUA) and International Urogynecology Journal, among

others, describing market size and growth trends.

Market size Bladder Pain Syndrome 2023-2034

Year

Source:

IMARC; https://www.imarcgroup.com/bladder- pain-syndrome-market

Hamlet BioPharma - the pharmaceutical company with a strong portfolio of projects for the treatment of cancer and infections – has three projects in Phase II clinical trials and promising assets in preclinical development, approaching the clinic.

THE PERIOD IN SUMMARY

THIRD QUARTER, JAN 1, 2025-MAR 31, 2025 (THE PARENT COMPANY)

– Net sales totaled KSEK 0 (0)

– Other operating income totaled KSEK 208 (0)

– Loss before tax amounted to KSEK -12,007 (-11,797)

– Loss after tax amounted to KSEK -12,007 (-11,797)

– Loss per share* was SEK -0.0676 (-0.0936)

FIRST NINE MONTHS, JUL 1, 2024-MAR 31, 2025 (THE PARENT COMPANY)

– Net sales totaled KSEK 0 (0)

– Other operating income totaled KSEK 208 (30)

– Loss before tax amounted to KSEK -35,660 (-28,781)

– Loss after tax amounted to KSEK -35,660 (-28,781)

– Loss per share* was SEK -0.2007 (-0.2284)

– On March 31, 2025, the equity/assets ratio** was 92.4 (94.3) %

THIRD QUARTER, JAN 1, 2025-MAR 31, 2025 (THE GROUP)

– Net sales totaled KSEK 0 (0)

– Other operating income totaled KSEK 208 (0)

– Loss before tax amounted to KSEK -12,505 (-12,296)

– Loss after tax amounted to KSEK -12,505 (-12,296)

– Loss per share* was SEK -0.0704 (-0.0976)

FIRST NINE MONTHS, JUL 1, 2024-MAR 31, 2025 (THE GROUP)

– Net sales totaled KSEK 0 (0)

– Other operating income totaled KSEK 208 (30)

– Loss before tax amounted to KSEK -37,157 (-30,278)

– Loss after tax amounted to KSEK -37,157 (-30,278)

– Loss per share* was SEK -0.2091 (-0.2403)

– On March 31, 2025, the equity/assets ratio** was 91.9 (94.1) %

Amounts in parentheses above and below indicate the corresponding value in the preceding year.

* Profit/loss after tax for the period divided by 177,685,127 (167,762,902), respectively, where 177,685,127 is the number of shares outstanding on March 31, 2025, the comparative figure in parentheses was the number of shares on March 31, 2024.

** Equity divided by total capital.

Revenue and earnings

The costs for the merged companies Hamlet BioPharma and SelectImmune Pharma reflect the larger project portfolio and the costs of the three clinical trials in Phase II. Hamlet BioPharma’s net sales amounted to KSEK 0 (0) during the third quarter. Other operating income amounted to KSEK 208 (0) during the third quarter. Costs were related to the continued drug development activities of the research team at Lund University. The team at Lund University is also responsible for the development of manufacturing methods, stability testing, and chemical and functional characterization of existing and new drug substances and plays a key role in the coordination of laboratory testing in the clinical trial. Costs in the group accounting also consists of depreciation of patent from the acquirement of Linnane Projects AB.

Loss before tax for the parent company for the third quarter was KSEK -12,007 (-11,797), and for the first nine months KSEK -35,660 (-28,781). Loss before tax for the group for the third quarter was KSEK -12,505 (-12,296), and for the first nine months KSEK -37,157 (-30,278).

Financial position

At the end of the third quarter, the equity/assets ratio was 92.4 (94.3) %, and the Company’s cash and cash equivalents were KSEK 20,002 (31,551).

Investments

The Company does not capitalize expenses for research and development as assets, since the Company is in an R&D stage. R&D costs are therefore recognized as operating expenses in the income statement.

Depreciation

During the quarter, depreciation of equipment amounted to KSEK 115 (107), and the depreciation of patents from the merger with SelectImmune Pharma AB amounted to KSEK 2,021 (2,021).

In the group, depreciation of patents, including the acquisition of Linnane Projects AB, amounted to KSEK 2,520 (2,520) during the quarter.

Employees

The company had the equivalent of 7 (7) full-time employees during the quarter.

The share

The Company’s shares have been traded on Spotlight Stock Market since October 23, 2015. The share is traded under the short name “HAMLET B” with ISIN code SE0015661152.

At the extraordinary general meeting in Hamlet Pharma AB on March 2, 2021, it was decided that the company’s common shares would undergo a split with relation 3:1 and would be reclassified as A- and B-shares.

The B-shares will be traded on Spotlight Stock Market. The A-shares will not be listed. Each A-share entitles to ten votes and B-shares entitles to one vote. Furthermore, it is possible for shareholders to convert A-shares to B-shares, which can be traded on Spotlight Stock Market. This conversion program is ongoing with no current deadline. This means that the ratio between A- and B-shares will change over time.

As of March 31, 2025, the number of shares registered at the Swedish Companies Registration Office (Bolagsverket) totaled 177,685,127. As of April 20, 2025, the registered current ratio of shares was 39,947,938 A-shares and 137,737,187 B-shares.

Subscription warrants

The company had no outstanding warrants as of March 31, 2025.

Transactions with related parties

During the quarter, KSEK 1,459 (1,370) was paid to Linnane Pharma AB, of which KSEK 1,339 (1,250) refers to the co-operation agreement, and KSEK 120 (120) refers to patent license.

The collaboration agreement grants access to advanced science and cutting-edge technology for drug development. The collaboration means that Linnane Pharma’s technology platform and other resources are available to Hamlet BioPharma. Hamlet BioPharma is a subsidiary company of Linnane Pharma AB, which owns 34.29% of the capital and 74.91% of the votes of Hamlet BioPharma. Catharina Svanborg, Chairman of Hamlet BioPharma, is the main owner of Linnane Pharma AB.

Furthermore, salaries and allowances to board and management were paid during the period. Transactions with related parties are on market terms.

Significant risks and uncertainties

The Board’s assessment of significant risks and uncertainties is unchanged compared with the most recent financial year and is described in the most recently published annual report (2024-06-30).

Basis of preparation for the interim report

The Company prepares its accounts in accordance with the Swedish Annual Accounts Act (Årsredovisnings- lagen) and the K3 framework (BFNAR 2012:1) of the Swedish Accounting Standards Board (Bokförings- nämnden).

The company’s accounting principles are unchanged compared with most recent financial year and are described in the most recently published annual report (2024-06-30).

On March 31st, 2023, Hamlet BioPharma acquired Linnane Projects AB from Linnane Pharma AB and the patents and know-how regarding a new peptide-based drug against tuberculosis as well as the know-how required to develop the project. In accordance with regulations at Spotlight and the Swedish Accounting Standards Board (Bokföringsnämnden), consolidated accounts of Linnane Projects and Hamlet BioPharma are drawn up. The quarterly report is prepared with the parent company’s accounting in focus. In texts, the group is only commented on if something differs significantly from the parent company.

Review

This interim report has not been audited.

Financial calendar

Year-end report (Q4), 2024/2025 August 28, 2025

Annual report for 2024/2025 October 31, 2025

Interim report for Q1, 2025/2026 November 14, 2025 Annual General Meeting for 2024/2025 November 20, 2025

INCOME STATEMENT: THE PARENT COMPANY

|

SEK |

|

2025-01-01 2025-03-31 |

2024-01-01 2023-03-31 |

|

2024-07-01 2025-03-31 |

2023-07-01 2024-03-31 |

|

2023-07-01 2024-06-30 |

|

Net sales |

|

0 |

0 |

|

0 |

0 |

|

0 |

|

Other operating income |

|

208 038 |

0 |

|

208 038 |

29 971 |

|

29 971 |

|

Operating income |

|

208 038 |

0 |

|

208 038 |

29 971 |

|

29 971 |

|

Other external costs |

|

-8 197 565 |

-7 710 493 |

|

-23 768 332 |

-18 064 389 |

|

-25 220 121 |

|

Employee benefit expenses |

|

-1 857 948 |

-2 123 719 |

|

-5 893 776 |

-5 719 874 |

|

-7 712 231 |

|

Depreciation of assets |

|

-2 136 285 |

-2 127 843 |

|

-6 406 780 |

-5 474 107 |

|

-7 609 148 |

|

Other operating expenses |

|

-7 970 |

-15 669 |

|

-50 079 |

-7 158 |

|

-27 545 |

|

Operating loss |

|

-11 991 730 |

-11 977 725 |

|

-35 910 928 |

-29 235 557 |

|

-40 539 074 |

|

Financial items |

|

-15 003 |

180 853 |

|

250 586 |

454 234 |

|

717 413 |

|

Loss before tax |

|

-12 006 733 |

-11 796 871 |

|

-35 660 343 |

-28 781 323 |

|

-39 821 661 |

|

Tax on loss for the period |

|

0 |

0 |

|

0 |

0 |

|

0 |

|

Loss after tax |

|

-12 006 733 |

-11 796 871 |

|

-35 660 343 |

-28 781 323 |

|

-39 821 661 |

BALANCE SHEET: THE PARENT COMPANY

|

Assets, SEK |

|

2025-03-31 |

2024-03-31 |

|

2024-06-30 |

|

ASSETS |

|

|

|

|

|

|

Fixed assets |

|

|

|

|

|

|

Intangible assets |

|

27 146 357 |

35 231 561 |

|

33 210 260 |

|

Tangible assets |

|

256 301 |

544 094 |

|

574 256 |

|

Financial assets |

|

10 000 000 |

10000000 |

|

10 000 000 |

|

Total fixed assets |

|

37 402 658 |

45 775 655 |

|

43 784 516 |

|

Current assets |

|

|

|

|

|

|

Other receivables |

|

4 898 746 |

1 913 531 |

|

3 727 639 |

|

Prepaid expenses |

|

263 277 |

3 483 600 |

|

471 474 |

|

Cash and bank balances/financial investments |

|

20 002 059 |

31 550 995 |

|

23 076 079 |

|

Total current assets |

|

25 164 083 |

36 948 126 |

|

27 275 192 |

|

Total assets |

|

62 566 740 |

82 723 781 |

|

71 059 708 |

|

EQUITY & LIABILITIES |

|

|

|

|

|

|

Restricted equity |

|

|

|

|

|

|

Share capital |

|

1 776 851 |

1 677 629 |

|

1 677 629 |

|

Statutory reserve |

|

20 000 |

20 000 |

|

20 000 |

|

Total restricted equity |

|

1 796 851 |

1 697 629 |

|

1 697 629 |

|

Non-restricted equity |

|

|

|

|

|

|

Share premium reserve |

|

251 751 833 |

225 337 658 |

|

225 337 658 |

|

Retained earnings |

|

-160 083 493 |

-120 261 832 |

|

-120 261 832 |

|

Loss for the period |

|

-35 660 343 |

-28 781 323 |

|

-39 821 661 |

|

Total non-restricted equity |

|

56 007 998 |

76 294 503 |

|

65 254 165 |

|

Total equity |

|

57 804 849 |

77 992 132 |

|

66 951 794 |

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

1 122 796 |

1 173 109 |

|

1 230 214 |

|

Tax liabilities |

|

26 428 |

69 162 |

|

181 994 |

|

Other liabilities |

|

353 067 |

359 726 |

|

297 279 |

|

Accrued expenses |

|

3 259 601 |

3 129 651 |

|

2 398 427 |

|

Total current liabilities |

|

4 761 891 |

4 731 649 |

|

4 107 914 |

|

Total Equity & Liabilities |

|

62 566 740 |

82 723 781 |

|

71 059 708 |

CASH FLOW STATEMENT: THE PARENT COMPANY

|

SEK |

|

2024-07-01 2025-03-31 |

2023-07-01 2024-03-31 |

|

2023-07-01 2024-06-30 |

|

Operating activities |

|

|

|

|

|

|

Loss after financial items |

|

-35 660 343 |

-28 781 323 |

|

-39 821 661 |

|

Adjusted for non-cash items, etc. |

|

6 406 780 |

5 474 107 |

|

5 838 114 |

|

Cash flow from operating activities before changes in working capital |

|

-29 253 563 |

-23 307 216 |

|

-33 983 547 |

|

Cash flow from changes in working capital |

|

|

|

|

|

|

Change in current receivables |

|

-962 910 |

-4 775 899 |

|

-3 577 882 |

|

Change in current liabilities |

|

653 978 |

2 183 075 |

|

1 559 340 |

|

Cash flow from operating activities |

|

-29 562 495 |

-25 900 040 |

|

-36 002 089 |

|

Investing activities |

|

|

|

|

|

|

Acquisition of tangible assets |

|

-24 922 |

-134 183 |

|

-278 085 |

|

Cash flow from investing activities |

|

-24 922 |

-134 183 |

|

-278 085 |

|

Financing activities |

|

|

|

|

|

|

Rights issue |

|

26 790 008 |

46 767 318 |

|

46 767 318 |

|

Issuance costs |

|

-276 610 |

-4 314 233 |

|

-4 314 233 |

|

Amortization of loans |

|

0 |

-5 000 000 |

|

-5 000 000 |

|

Merger with SelectImmune Pharma AB |

|

0 |

1 764 278 |

|

3 535 312 |

|

Cash flow from financing activities |

|

26 513 398 |

39 217 363 |

|

40 988 397 |

|

Cash flow for the period |

|

-3 074 020 |

13 183 140 |

|

4 708 224 |

|

Cash and cash equivalents at the beginning of the period |

|

23 076 079 |

18 367 855 |

|

18 367 855 |

|

Cash and cash equivalents at the end of the period |

|

20 002 059 |

31 550 995 |

|

23 076 079 |

EQUITY: THE PARENT COMPANY

|

SEK |

Share capital |

Statutory reserve |

Share premium reserve |

Retained earnings |

Loss for the period |

Total |

|

Opening balance July 1, 2024 |

1 677 629 |

20 000 |

225 337 658 |

-120 261 832 |

-39 821 661 |

66 951 794 |

|

Transfer of prior year’s loss |

|

|

|

-39 821 661 |

39 821 661 |

0 |

|

Rights issue |

99 222 |

|

26 414 175 |

|

|

26 513 398 |

|

Loss for the period, Q1 |

|

|

|

|

-9 765 592 |

-9 765 592 |

|

Loss for the period, Q2 |

|

|

|

|

-13 888 017 |

-13 888 017 |

|

Loss for the period, Q3 |

|

|

|

|

-12 006 733 |

-12 006 733 |

|

Equity March 31, 2025 |

1 776 851 |

20 000 |

251 751 833 |

-160 083 493 |

-35 660 343 |

57 804 849 |

INCOME STATEMENT: THE GROUP

|

SEK |

|

2025-01-01 2025-03-31 |

2024-01-01 2024-03-31 |

|

2024-07-01 2025-03-31 |

2023-07-01 2024-03-31 |

|

2023-07-01 2024-06-30 |

|

Net sales |

|

0 |

0 |

|

0 |

0 |

|

0 |

|

Other operating income |

|

208 038 |

0 |

|

208 038 |

29 971 |

|

29 971 |

|

Operating income |

|

208 038 |

0 |

|

208 038 |

29 971 |

|

29 971 |

|

Other external costs |

|

-8 197 565 |

-7 710 493 |

|

-23 768 332 |

-18 064 389 |

|

-25 220 121 |

|

Employee benefit expenses |

|

-1 857 948 |

-2 123 719 |

|

-5 893 776 |

-5 719 874 |

|

-7 712 231 |

|

Depreciation of assets |

|

-2 635 035 |

-2 626 593 |

|

-7 903 030 |

-6 970 357 |

|

-9 604 148 |

|

Other operating expenses |

|

-7 970 |

-15 669 |

|

-50 079 |

-7 158 |

|

-27 545 |

|

Operating loss |

|

-12 490 480 |

-12 476 475 |

|

-37 407 178 |

-30 731 807 |

|

-42 534 074 |

|

Financial items |

|

-15 003 |

180 853 |

|

250 586 |

454 234 |

|

717 413 |

|

Loss before tax |

|

-12 505 483 |

-12 295 621 |

|

-37 156 593 |

-30 277 573 |

|

-41 816 661 |

|

Tax on loss for the period |

|

0 |

0 |

|

0 |

0 |

|

0 |

|

Loss after tax |

|

-12 505 483 |

-12 295 621 |

|

-37 156 593 |

-30 277 573 |

|

-41 816 661 |

|

Attributable to |

|

|

|

|

|

|

|

|

|

The parent company's shareholders |

|

-12 505 483 |

-12 295 621 |

|

-37 156 593 |

-30 277 573 |

|

-41 816 661 |

|

Holdings without controlling influence |

|

0 |

0 |

|

0 |

0 |

|

0 |

BALANCE SHEET: THE GROUP

|

SEK |

|

2025-03-31 |

2024-03-31 |

|

2024-06-30 |

|

ASSETS |

|

|

|

|

|

|

Fixed assets |

|

|

|

|

|

|

Intangible assets |

|

33 131 357 |

43 211 561 |

|

40 691 510 |

|

Tangible assets |

|

256 301 |

544 094 |

|

574 256 |

|

Financial assets |

|

0 |

0 |

|

0 |

|

Total fixed assets |

|

33 387 658 |

43 755 655 |

|

41 265 766 |

|

Current assets |

|

|

|

|

|

|

Other receivables |

|

4 898 746 |

1 913 531 |

|

3 727 639 |

|

Prepaid expenses |

|

263 277 |

3 483 600 |

|

471 474 |

|

Cash and bank balances/financial investments |

|

20 027 059 |

31 575 995 |

|

23 101 079 |

|

Total current assets |

|

25 189 083 |

36 973 126 |

|

27 300 192 |

|

Total assets |

|

58 576 740 |

80 728 781 |

|

68 565 958 |

|

EQUITY & LIABILITIES |

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Share capital |

|

1 776 851 |

1 677 629 |

|

1 677 629 |

|

Other contributed capital |

|

251 771 833 |

225 357 658 |

|

225 357 658 |

|

Other equity including loss for the period |

|

-199 733 835 |

-151 038 155 |

|

-162 577 243 |

|

Total equity attributable to the parent company's shareholders |

|

53 814 849 |

75 997 132 |

|

64 458 044 |

|

Holdings without controlling influence |

|

0 |

0 |

|

0 |

|

Total equity |

|

53 814 849 |

75 997 132 |

|

64 458 044 |

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

1 122 796 |

1 173 109 |

|

1 230 214 |

|

Tax liabilities |

|

26 428 |

69 162 |

|

181 994 |

|

Other liabilities |

|

353 067 |

359 726 |

|

297 279 |

|

Accrued expenses |

|

3 259 601 |

3 129 651 |

|

2 398 427 |

|

Total current liabilities |

|

4 761 891 |

4 731 649 |

|

4 107 914 |

|

Total Equity & Liabilities |

|

58 576 740 |

80 728 781 |

|

68 565 958 |

CASH FLOW STATEMENT: THE GROUP

|

SEK |

|

2024-07-01 2025-03-31 |

2023-07-01 2024-03-31 |

|

2023-07-01 2024-06-30 |

|

Operating activities |

|

|

|

|

|

|

Loss after financial items |

|

-37 156 593 |

-30 277 573 |

|

-41 816 661 |

|

Adjusted for non-cash items, etc. |

|

7 903 030 |

6 970 357 |

|

7 833 114 |

|

Cash flow from operating activities before changes in working capital |

|

-29 253 563 |

-23 307 216 |

|

-33 983 547 |

|

Cash flow from changes in working capital |

|

|

|

|

|

|

Change in current receivables |

|

-962 910 |

-4 775 899 |

|

-3 577 882 |

|

Change in current liabilities |

|

653 978 |

2 183 075 |

|

1 559 340 |

|

Cash flow from operating activities |

|

-29 562 495 |

-25 900 040 |

|

-36 002 089 |

|

Investing activities |

|

|

|

|

|

|

Acquisition of tangible assets |

|

-24 922 |

-134 183 |

|

-278 085 |

|

Cash flow from investing activities |

|

-24 922 |

-134 183 |

|

-278 085 |

|

Financing activities |

|

|

|

|

|

|

Rights issue |

|

26 790 008 |

46 767 318 |

|

46 767 318 |

|

Issuance costs |

|

-276 610 |

-4 314 233 |

|

-4 314 233 |

|

Amortization of loans |

|

0 |

-5 000 000 |

|

-5 000 000 |

|

Merger with SelectImmune Pharma AB |

|

0 |

1 764 278 |

|

3 535 312 |

|

Cash flow from financing activities |

|

26 513 398 |

39 217 363 |

|

40 988 397 |

|

Cash flow for the period |

|

-3 074 020 |

13 183 140 |

|

4 708 224 |

|

Cash and cash equivalents at the beginning of the period |

|

23 101 079 |

18 392 855 |

|

18 392 855 |

|

Cash and cash equivalents at the end of the period |

|

20 027 059 |

31 575 995 |

|

23 101 079 |

EQUITY: THE GROUP

|

SEK |

Share capital |

Other contributed capital |

Other equity incl profit for the period |

Total |

|

Opening balance July 1, 2024 |

1 677 629 |

225 357 658 |

-162 577 243 |

64 458 044 |

|

Transfer of prior year’s loss |

|

|

0 |

0 |

|

Rights issue |

99 222 |

26 414 175 |

|

26 513 398 |

|

Loss for the period, Q1 |

|

|

-10 264 342 |

-10 264 342 |

|

Loss for the period, Q2 |

|

|

-14 386 767 |

-14 386 767 |

|

Loss for the period, Q3 |

|

|

-12 505 483 |

-12 505 483 |

|

Equity March 31, 2025 |

1 776 851 |

251 771 833 |

-199 733 835 |

53 814 849 |

The Board of Directors and the Chief Executive Officer assure that the interim report provides a true and fair view of the Company’s operations, position, and results.

Malmö, May 22, 2025

Gabriela Godaly Catharina Svanborg

Chairman of the Board CEO

Bill Hansson Magnus Nylén

Board member Board member

![]()

![]() For further information:

For further information:

Hamlet BioPharma AB

Klinikgatan 32

222 42 Lund

Catharina Svanborg, CEO

Tel: +46 709 42 65 49

E-mail: catharina.svanborg@hamletpharma.com

Gabriela Godaly, Chairman of the Board

Tel: +46 (0)73-338 13 44

E-mail: gabriela.godaly@med.lu.se